What are semiconductors anyway?

What are semiconductors anyway?

I’m sure you’ve heard the term: semiconductor. You know it somehow relates to computers and artificial intelligence. But what exactly are they? In what way are they connected to the booming world of AI, and is it an industry worth investing in?

What is a Semiconductor?

At its core, a semiconductor is a material—most commonly silicon—that can conduct electricity sometimes, but not always. That might sound vague, but it’s actually the key feature that makes modern electronics possible.

Unlike conductors (such as copper, which always conduct electricity) or insulators (such as rubber, which never do), semiconductors can be precisely controlled. By adding small impurities through a process called “doping,” engineers can dictate when, where, and how electricity flows.

This ability to control electrical flow allows semiconductors to act as switches—turning signals on and off billions of times per second. Those switches are the foundation of all computing.

From Semiconductors to Chips

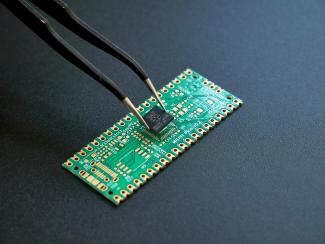

Semiconductors are not used in raw form. They are manufactured into integrated circuits, more commonly known as chips. A single chip can contain billions of microscopic transistors, each acting as a tiny on/off switch.

These chips are found everywhere:

Computers and laptops

Smartphones and tablets

Cars and medical devices

Data centers and cloud infrastructure

Different chips serve different purposes. Some are designed to process general tasks, while others are optimized for graphics, networking, memory, or specialized workloads like AI.

How Semiconductors Power Computers

Every computer—whether it’s a laptop or a massive server—relies on semiconductors to perform three basic functions:

Processing – The CPU (central processing unit) executes instructions and calculations.

Memory – RAM and storage chips hold data temporarily or permanently.

Communication – Chips manage how data moves within the device and across networks.

Without semiconductors, computers would simply not exist. The exponential growth in computing power over the past several decades—often described by Moore’s Law—has been driven by the ability to pack more transistors into smaller, more efficient chips.

How Semiconductors Relate to AI

Artificial intelligence dramatically increases the importance of semiconductors. AI models require enormous amounts of computing power and the ability to perform trillions of calculations, far beyond what traditional chips were originally designed to handle.

To deal with this, specialized chips—such as GPUs (graphics processing units) and AI accelerators—have become essential. These chips are optimized to perform parallel calculations at extremely high speeds, making them ideal for machine learning and neural networks.

In short, AI is not just software. It is deeply dependent on hardware—and semiconductors are that hardware.

In other words, a specialized chip is like a super freeway—allowing far more information to move simultaneously and at much higher speeds—while traditional chips are more comparable to a two-lane highway.

The Semiconductor Supply Chain

Another reason semiconductors receive so much attention is the complexity of their supply chain. Designing chips, manufacturing them, and assembling them are often handled by different companies across multiple countries.

Key stages include:

Design – Creating the architecture and logic of the chip

Fabrication – Manufacturing the chip in advanced fabrication facilities

Packaging and testing – Preparing chips for real-world use

This global dependency has made semiconductors a strategic priority for governments and corporations alike, particularly after supply disruptions in recent years highlighted how critical they are to economic stability and national security.

Why Investors Are Paying Attention

From an investment perspective, semiconductors sit at the intersection of multiple long-term trends: Artificial intelligence - Cloud computing – Automation - Electric vehicles - Data growth

In 2025, the semiconductor index rose over 40%. However, where there is reward there is typically risk, as the index was down over -35% in 2022. The industry is highly cyclical, capital-intensive, and competitive. Innovation moves fast, and leadership can change quickly.

As technology and artificial intelligence continue to expand, demand for advanced chips is expected to grow alongside them. This makes semiconductor investing potentially rewarding—but not without risk.

Bottom Line

Semiconductors are the invisible engines powering modern life. They enable computers, smartphones, data centers, and now AI systems that are reshaping entire industries. While AI may grab headlines, it cannot exist without the chips underneath it.

Ryan Page, CFP®, MBA®

Office & Text:720-826-1092

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.