Taxes at a Glance, Will They Be Higher or Lower in 10 Years?

Taxes at a Glance, Will They Be Higher or Lower in 10 Years?

It’s everyone’s biggest expense throughout their lifetime. Taxes. Your income is taxed, your investment gains are taxed, your real estate is taxed, your purchases are taxed and when you pass, your estate could even be taxed.

It’s income tax that will typically take the biggest chunk out of your wealth though. You may be surprised to hear that as of now, in 2025, income tax rates are historically low.

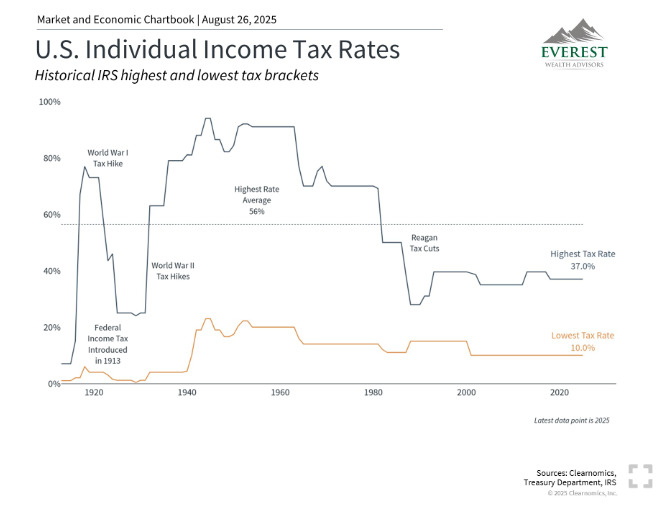

Take a look at the chart below:

As we can see, for both high- and low-income earners, the tax rate is low relative to the past 80 years or so. But it’s especially low, relatively speaking, for high income earners, who have seen their highest tax brackets reach well above 50% for significant periods of time, peaking at a 94% marginal tax rate in the 1940’s.

Imagine being an accountant during those times! The good news is ever since the Reagan era in the 1980’s, income taxes have dropped sharply and although they have fluctuated a bit, have not come close to reaching those highs we saw in the middle of the century.

Being that taxes are such a significant expense that never goes away, it is a crucial part of financial planning. The challenge is knowing where tax rates may go from here, which of course we can’t with certainty. We can, however, attempt to form a reasonable estimation on whether they will be higher or lower in the future.

Given their current low levels, along with an ever-growing national debt (over $37 trillion and counting), and a Social Security fund that won’t be able to meet its full obligations by 2034, there are some clear signs pointing to the government needing to raise additional revenue in the near future.

What This Means for Your Financial Planning

If taxes are “on sale” today, it makes sense to consider strategies that take advantage of this limited-time opportunity.

1. Roth Conversions

Shifting assets from a traditional IRA to a Roth IRA means paying taxes now at today’s historically low rates, rather than later at potentially higher ones. Once inside a Roth, growth and withdrawals can be tax-free.

2. Accelerating Income or Gains

For some people, it may make sense to recognize income sooner—for example, selling appreciated assets or exercising stock options—if you believe future tax rates will be higher.

3. Estate Planning Moves

Low rates also affect strategies for wealth transfer. Making gifts, funding trusts, or converting retirement assets can all be more efficient in a low-tax environment.

4. Tax Diversification

Just as you diversify investments, diversify your tax exposure. Balancing pre-tax, Roth, and taxable accounts gives you flexibility no matter what future rates look like.

Bottom Line:

It’s impossible to plan perfectly for a variable that is ultimately uncertain, but there is adequate reason to believe in a stronger chance than not that taxes will be higher 10 to 20 years from now than they are today.

The good news is that there are ways to take advantage of this so you can be in a better spot down the road.

If you’d like to discuss tax planning, in additional to all the other elements of your finances, reach out to our team. We can look at your big picture, and help you plan the next steps for an independent financial future.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.