How do you take care of your spouse while also protecting your children’s inheritance? A QTIP trust can help you do both—providing income for your spouse while

Read More

No one likes paying taxes. But making financial decisions purely to avoid them can backfire. This article explains how to keep your focus on what really matters

Read More

“To convert, or not to convert; that is the question.” Not as philosophical or existential as Shakespeare’s original phrase, but perhaps if he was a modern-day

Read More

Retirement isn’t usually derailed by one catastrophic decision. More often, it’s the small delays, misunderstandings, and “I’ll deal with it later” moments that

Read More

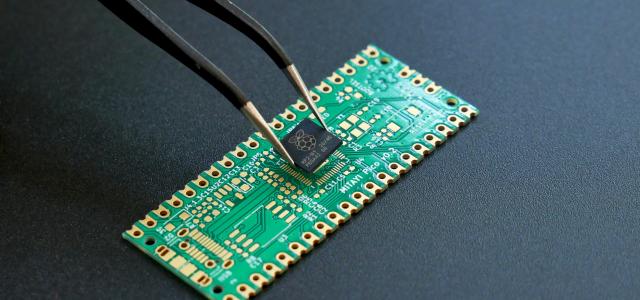

Semiconductors may not grab headlines like artificial intelligence itself, but they are the backbone that makes AI possible. From computers and smartphones to

Read More

What happens if both spouses die at the same time — or so close together that no one knows who passed first? While rare, this scenario can create major estate

Read More

Most people think a deduction is a deduction—but that’s not how the tax code works. Some deductions reduce your income before it’s even taxed, while others only

Read More

Often overlooked in the estate planning world are our beloved pets. Just as we want our children, family members, and loved ones to be taken care of when we’re

Read More

This is a smart question to ask and one I’ve heard before. As with many financial planning questions, the answer is: it depends.

Read More

What Happened to Pensions?

There was a time when pensions, also known as defined benefit plans, were common. There was something else that was common during

Probably, but not necessarily. A will may be sufficient in some cases, but using both together provides a far more complete and effective plan for protecting

Read More

A government shutdown makes headlines, but how do markets actually respond? History shows that while shutdowns spark short-term volatility, the bond market

Read More